Over recent years, India's investment landscape has shifted significantly as investors seek new alternatives with better risk-reward profiles. These alternative investment options can offer high returns with low volatility, aiding in portfolio diversification.

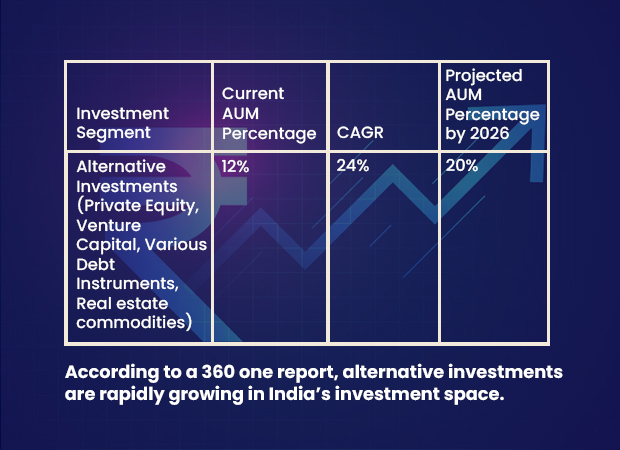

The fastest-growing segment in India's investment space is alternative investments like private equity, venture capital, and various debt instruments, which have been growing at a 24% CAGR and now represent 12% of India's AUM. According to a 360 One report, alternatives could constitute 20% of India's total AUM by 2026.

Historically, these investment options were the domain of large institutional investors. However, this is changing, making it increasingly important for individual investors to understand these opportunities.

This article provides an overview of various alternative investment options and the latest trends in the industry.

A. Recent Alternative Investment Trends in India

- Fractional Ownership: This concept is gaining traction in India, allowing investors to participate in high-ticket investments by owning a fraction of an asset, such as startup equity or real estate. According to Knight Frank, India's fractional ownership market (real estate) is expected to grow to $8.9 billion by 2025, at a CAGR of 10.5%.

- Regulated and Tech-Enabled Platforms: The rise of compliant, tech-enabled platforms is democratizing alternative investments, making them accessible to retail investors and increasing awareness.

- Increasing Demand for Diversification: Investors are increasingly diversifying their portfolios to protect against volatility and achieve inflation-beating returns. Some alternative investments offer this balance due to their non-market-linked nature.

B. 5 Best Alternative Investments Worth Exploring

1.Securitized Debt Instruments (SDIs)

Benefits:

- High, Fixed, Non-Market Linked Returns: Offers up to 16% IRR.

- Faster Principal Repayment : Monthly/quarterly returns help reduce risk and ensure quicker repayment.

- Easy Diversification : Invest in a pool of underlying assets across categories.

- Security Cover: Measures like over-collateralization and cash collateral provide safeguards.

Limitations:

- Default Risk: Risk of borrower default despite security measures.

- Non-Liquid Nature: Less liquid than stocks or mutual funds.

- Complexity: Requires time and knowledge to understand, though platforms like Grip Invest simplify the process.

2. Commercial Real Estate (CRE)

Benefits :

- Passive Income Generation: Higher rental yields and longer leases offer predictability.

- Potential for Value Appreciation: Long-term property appreciation.

- Strong Underlying Asset: High degree of capital protection.

Limitations:

- High Initial Investment : Significant upfront capital required, though fractional ownership is lowering the entry barrier.

- Liquidity: Selling properties can be challenging.

- Tenant Risk: Dependence on tenants can lead to vacancies and payment defaults.

3. Private Equity and Venture Capital

Benefits:

- Access to Innovation: Invest in innovative startups and disruptive technologies.

- High Return Potential: Potentially higher returns than traditional assets.

- Diversification: Spread investments across various industries and stages.

Limitations:

- Lliquidity: Investments can be tied up for extended periods.

- High Fees: Management and performance fees can reduce actual returns.

- High Risk: Significant risk as many startups may fail.

4. Peer-to-Peer Lending (P2P)

Benefits :

- Accessibility : Provides funding options for individuals and small businesses overlooked by traditional banks.

- Quick Process: Faster access to funds.

- High Returns: Higher interest rates compared to conventional banks.

Limitations :

- Credit Risk: High risk of borrower default.

- Evolving Regulations: Limited regulatory oversight and history.

- Platform Risk: Varying credibility and risk management across platforms.

5. Cryptocurrencies

Benefits:

- Potential for Quick Returns: Significant short-term movement can yield high profits during a bull run.

- Accessibility: Broad participation due to ease of access.

Limitations:

- Regulatory Uncertainty: Uncertain regulatory environment in India with potential for bans.

- Market Volatility: Highly volatile and unpredictable.

- Lack of Consumer Protection: No central authority backing, raising security and reliability concerns.

Conclusion

Alternative investment options in India are rapidly growing, presenting significant opportunities for savvy investors. The best choice depends on individual investment strategies and risk tolerance. Explore Yield Yard for high-yielding fixed-income alternative investments.

Post A Comment