Real Estate as an investment option has long been the preferred choice generally for people who have deep pockets and limited liabilities. Concerns of liquidity and lack of regulations had been holding back investments by the majority of the people.

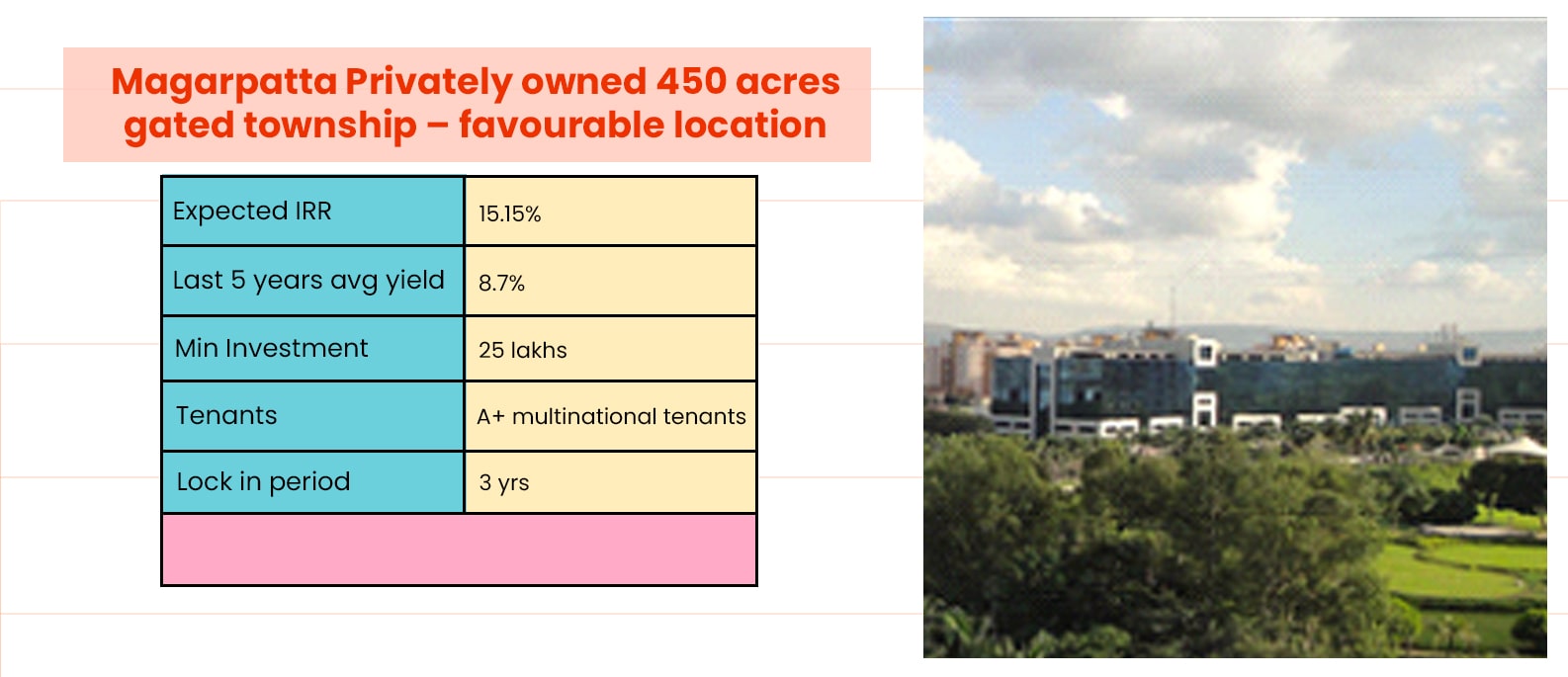

But new proptech firms have been trying to solve this issue to make it more accessible and acceptable for the masses. Most of the proptech firms have a long history of real estate investing and are trusted partners. These fractional ownership platforms have launched multiple properties which very well adapts to the concept of ‘asset tokenization’.