Vikram Solar announces resolutions for private placement and Articles of Association updates. The company will issue up to 5,99,54,996 equity shares at Rs. 122 per share, raising Rs. 731.45 crore from specified non-promoter investors to expand its investor base and raise additional capital.

| Quantity | Rate/Share |

|---|---|

| 100 - 1000 | 283.00 |

| P/E | 401.79 | P/S | 3.46 | P/B | 6.35 |

|---|---|---|---|---|---|

| Industry PE | 37.57 | Face Value | 10 | Book Value | 35.46 |

| Market Cap | 7172.66 Cr | Dividend | 0 | Dividend Yield | 0 % |

Corporate Action of Vikram Solar Unlisted Share Prices

| Financial Year | Particulars | Record Date | Ratio/Rates/Amount | Remarks |

|---|---|---|---|---|

| 2021-22 | BONUS | 04-Dec-2021 | 10:1 | Vikram solar has issued 10 bonus shares for every 1 share. |

About of Vikram Solar Ltd.

Vikram Solar Limited (VSL), as per its credit rating report, is engaged in the business of providing solar energy solutions, manufacturing, and exporting PV modules and undertakes engineering, procurement, and construction (EPC) of solar power plants. VSL has its manufacturing facility located in Falta Special Economic Zone (FSEZ) in West Bengal with an installed capacity of 1.2 GW of solar PV module. It has recently set up another manufacturing plant in Chennai with 1 GW of capacity. The company operates and sells power from a 10-MW solar power plant, which has a long-term power purchase agreement with the Tirupati temple. The company was incorporated in 2005 and has its registered office located in Kolkata, West Bengal.

Overview of Vikram Solar Ltd.

Vikram Solar's Journey

2005: Incorporation Vikram Solar begins its journey towards revolutionizing India’s solar energy landscape.

2011: Early Milestone Installed a 3 MW project under the National Solar Mission of India, marking a significant step forward in renewable energy implementation.

2013: Landmark Achievement Contributed to the solarisation of the first fully solarised airport in India – Cochin International Airport, Kerala, showcasing the potential of solar energy in large-scale infrastructure projects.

2014: Recognition and Innovation Earned the distinction of being India’s only Tier 1 module manufacturer and commissioned India’s first floating solar plant, demonstrating innovative approaches to solar energy deployment.

2015: Scaling Production Reached a production capacity of 500 MW/year, signaling substantial growth and commitment to meeting the rising demand for solar energy solutions.

2017: Industry Leadership Achieved a significant milestone by reaching a production capacity of 1 GW/year, solidifying its position as a leader in the Indian solar industry.

2019: Expansion and Impact Commissioned a 200 MW plant in Andhra Pradesh and East India’s largest single shed rooftop project, totaling 2.15 MW, contributing to both utility-scale and distributed solar energy generation.

2021: Scaling New Heights Reached a production capacity of 2.5 GW, firmly establishing itself as one of India’s largest solar module manufacturers, driving the nation’s transition towards clean and sustainable energy sources.

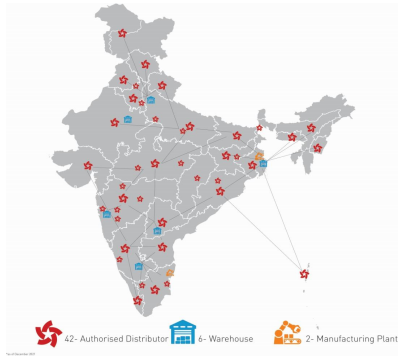

Vikram Solar's Extensive Domestic Network

With an extensive domestic presence, Vikram Solar operates across 23 states and 3 union territories in India, supported by a robust network of 42 distributors, 56 trusted resellers, and 97 empanelled system integrators

Global Expansion

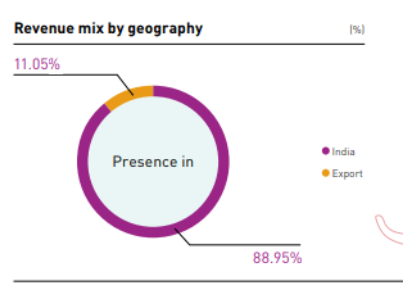

Vikram Solar has expanded globally with a sales office in the USA and a procurement office in China. They’ve supplied solar PV modules to clients in 32 countries. Domestically, key clients include NTPC, Rays Power Infra, and Hindustan Petroleum, while internationally, they serve companies like Amp Solar Development Inc and Safari Energy LLC. Learn how Vikram Solar is preparing to start production in the US.

Business Division

1. Solar PV Module Manufacturing:

Vikram Solar manufactures high-efficiency solar modules using both monocrystalline and polycrystalline cell technology. Their products can be categorized based on the use of solar cell technology and cell size.

| BASED ON USE OF TECHNOLOGY | BASED ON SIZE OF SOLAR CELLS |

|---|---|

| Monocrystalline Passive Emitter and Rear Cell (Mono PERC) modules | M6 size cell (166 mm x 166 mm) |

| Polycrystalline modules | M10 size cell (182 mm x 182 mm) |

| – | G12 size cell (210 mm x 210 mm) (a prototype under third-party lab testing) |

2. Solar EPC and Rooftop Solutions

Vikram Solar stands as one of India’s top five Engineering, Procurement, and Construction (EPC) players, leveraging over a decade of experience and a robust portfolio comprising more than 300 projects as of March 31, 2024. The company’s proficiency in executing EPC projects for solar plants is widely acknowledged, cementing its prominent position within the industry. Vikram Solar’s capabilities span the entire project lifecycle, encompassing concept development, engineering, execution, commissioning, and ongoing operations and maintenance.

3. Operation and Maintenance Services

Over the years, Vikram Solar has established a sustainable O&M business division to provide customers with forward-integrated full life cycle services. Their O&M services include repairs, ongoing maintenance, and complete operational solutions. These services are primarily offered for executed EPC projects as bundled value-add services. Vikram Solar provides these services across India and to clients in industries such as railways, airports, hospitals, defense, and automobile.

Brand Portfolio

| BRAND | DESCRIPTION | APPLICATION | TECHNOLOGY |

|---|---|---|---|

| Somera | Economical module with low sunlight response, using Mono PERC technology. | Projects with land constraints in developing markets. | Mono PERC |

| Paradea | Maximizes bifaciality, suitable for reflective surfaces like snow or sand. | Utility scale projects in various markets. | Bifacial |

| Prexos | Lightweight module for rooftops with various roofing materials. | Rooftop projects, especially in heavy snowfall areas. | Lightweight |

| Smart PV | Niche module with app-based technology for remote monitoring. | Commercial and industrial rooftops with shadow issues. | Smart technology |

Vikram Solar doesn’t just make solar panels – they also provide complete solar energy solutions. They’ve built over 300 solar plants and are currently working on more, totaling 1.42 GW in capacity. Plus, they take care of these plants even after they’re built, offering maintenance services for over 900 MW of solar energy projects.

They’re also big on rooftop installations, having completed over 190 projects across different areas and industries, including some impressive ones like a massive 5 MW solar carport at Maruti Udyog Limited. To make sure everything runs smoothly, they’ve sorted out their supply chain, making it easier to get the materials they need on time and at a good price.

Manufacturing Units and Expansion

- Tier 1 Manufacturer: According to Bloomberg New Energy Finance's 2020 report, Vikram Solar is classified as a Tier 1 solar PV module manufacturer.

- State-of-the-Art Equipment: The company utilizes advanced manufacturing equipment imported from the US, Germany, Japan, and Switzerland to ensure high-quality production.

- In-House R&D Facility: Vikram Solar maintains an in-house research and development facility to stay ahead of industry trends and incorporate cutting-edge technology into their panels.

- Production Capacity: Upgraded manufacturing unit's production capacity surpassed the 1 GW mark in 2017, currently standing at 1.2 GW, positioning the company among the top manufacturers.

- Geographical Location: The manufacturing unit is located near Kolkata, facilitating efficient operations and logistics.

- Expansion Plans: Vikram Solar has signed an MoU with the Tamil Nadu state government to establish another 3 GW manufacturing unit in the state over the next five years, demonstrating its commitment to expansion and growth.

Insights of Vikram Solar Ltd.

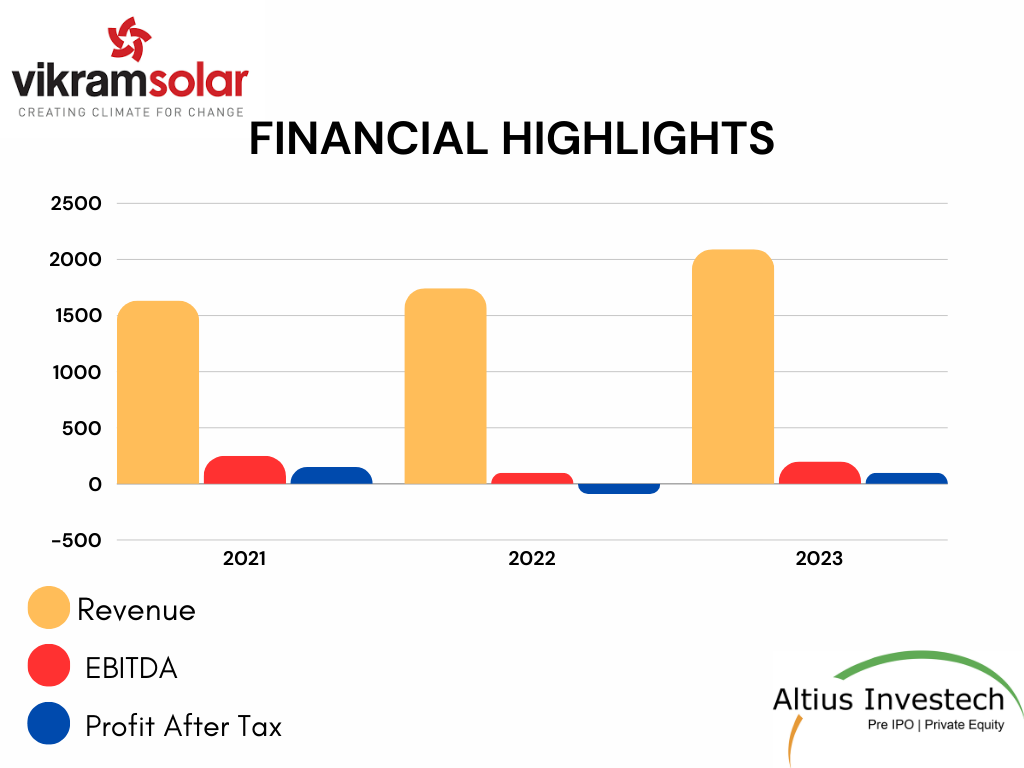

Financial Highlights

₹ in crores

| Particulars | FY 2020-2021 | FY 2021-2022 | FY 2022-2023 |

| Revenue | 1633.25 | 1743.04 | 2091.91 |

| EBITDA | 177.71 | 58.68 | 186.68 |

| Profit After Tax | 38.15 | (62.94) | 14.49 |

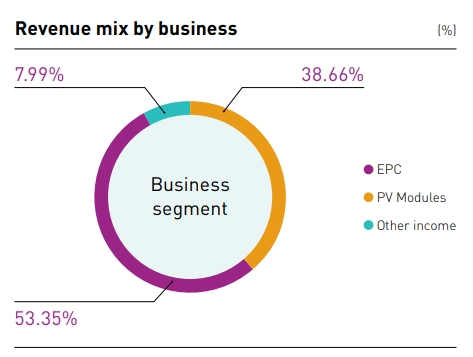

Revenue Breakup

Recent Update

On May 23, 2024, Vikram Solar issued up to 5,99,54,996 equity shares at ₹122 per share, raising approximately ₹731Crs. from investors to expand its investor base and raise additional capital.

The group of investors include Niveshaay Hedgehogs LLP, GVA Consultants LLP, Kaliedo Capital Advisors and Family offices and high-net-worth individuals.

Expected change in Capital due to the fundraise based on FY23 data:

Share Capital:

- Present: 258.83 Crs

- Increase: ₹10 * 5.99Crs. (Face value * no of shares) = 59,95,49,960

- Total: 318.78 Crs.

Reserves: Share premium

- Present: 128.68 Crs.

- Increase: ₹112 * 5.99 Crs. ((Amount – FV) * no of shares) = 670.88 Crs

- Total: 799.56 Crs.

Industry Overview

Global Solar PV Market Forecast

The global solar market is expected to grow at a faster pace over the next five years due to higher global renewable

installations driven by the stronger policy support and ambitious climate targets announced for COP26. The International

Energy Agency (IEA) forecasts that global solar capacity additions could reach approximately 1100 GW between 2021 and

2026, averaging 181.4 GW per year, nearly double the rate (93.5 GW) over the preceding five years.

Risk

- Risk of Inefficient Expansion: Vikram Solar's success is vulnerable to the effectiveness of its new factory construction and the scalability of its solar panel production. Inadequate execution could lead to suboptimal outcomes and financial strain.

- Uncertainty Regarding Government Policies: The company faces the risk of not fully leveraging beneficial government policies, such as the PLI scheme, which could hinder its competitive position and growth potential in the industry.

- Supply Chain Vulnerability: Vikram Solar's lack of long-term agreements with suppliers of raw materials exposes it to supply chain disruptions. Any difficulty in sourcing essential raw materials for solar panel production could impede operations and profitability.

- Dependency on Single Revenue Stream: With the majority of its revenue derived from the sale of solar panels, Vikram Solar is exposed to the risk of revenue fluctuations and market volatility associated with its singular product offering.

- Raw Material Price Volatility: Fluctuations in the prices of crucial raw materials like wafers and solar cells pose a significant risk to Vikram Solar's profitability and financial stability, potentially impacting its ability to maintain competitive pricing and margins

Balance Sheet of Vikram Solar Ltd.

Standalone(in ₹ Cr.)

| Category | 31-Mar-2023 | 31-Mar-2022 | 31-Mar-2021 | 31-Mar-2020 | 31-Mar-2019 | 31-Mar-2018 | 31-Mar-2017 |

|---|---|---|---|---|---|---|---|

| Equity | 399.85 | 386.40 | 441.42 | 394.45 | 380.62 | 346.84 | 282.12 |

| Liabilities | 2045.70 | 1836.20 | 1280.00 | 1183.95 | 1067.13 | 960.99 | 903.40 |

| Total Equity and Liabilities | 2445.54 | 2222.60 | 1721.42 | 1578.41 | 1447.75 | 1307.83 | 1185.52 |

| Net Fixed Assets | 627.05 | 541.60 | 380.99 | 356.38 | 335.30 | 299.10 | 316.36 |

| Capital Work-in-progress | 8.03 | 3.57 | 66.55 | 10.91 | 11.84 | 45.22 | 3.36 |

| Other Non current Assets | 95.54 | 98.36 | 94.82 | 92.51 | 68.92 | 67.38 | 73.25 |

| Current Assets | 1714.93 | 1579.06 | 1179.06 | 1118.61 | 1031.68 | 896.12 | 792.55 |

| Total Assets | 2445.54 | 2222.60 | 1721.42 | 1578.41 | 1447.75 | 1307.83 | 1185.52 |

Consolidated(in ₹ Cr.)

| Category | 31-Mar-2023 | 31-Mar-2022 | 31-Mar-2021 | 31-Mar-2020 | 31-Mar-2019 | 31-Mar-2018 | 31-Mar-2017 |

|---|---|---|---|---|---|---|---|

| Equity | 377.53 | 370.88 | 431.43 | 378.48 | 365.85 | 329.83 | 259.42 |

| Liabilities | 2098.76 | 1866.35 | 1294.76 | 1197.91 | 1067.89 | 960.38 | 915.65 |

| Total Equity and Liabilities | 2476.29 | 2237.23 | 1726.19 | 1576.39 | 1433.74 | 1290.21 | 1175.07 |

| Net Fixed Assets | 644.42 | 546.60 | 381.27 | 356.63 | 335.42 | 299.25 | 316.53 |

| Capital Work-in-progress | 17.77 | 3.57 | 66.55 | 10.91 | 11.84 | 45.22 | 3.36 |

| Other Non current Assets | 61.16 | 67.81 | 67.39 | 64.50 | 56.59 | 55.58 | 59.25 |

| Current Assets | 1752.94 | 1619.25 | 1210.99 | 1144.34 | 1029.88 | 890.16 | 795.93 |

| Total Assets | 2476.29 | 2237.23 | 1726.19 | 1576.39 | 1433.74 | 1290.21 | 1175.07 |

Profit and Loss of Vikram Solar Ltd.

Standalone(in ₹ Cr.)

| Category | 31-Mar-2023 | 31-Mar-2022 | 31-Mar-2021 | 31-Mar-2020 | 31-Mar-2019 | 31-Mar-2018 | 31-Mar-2017 |

|---|---|---|---|---|---|---|---|

| Net Revenue | 2006.48 | 1700.47 | 1576.59 | 1519.58 | 1937.96 | 1894.42 | 1702.29 |

| Total Operating Cost | 1824.64 | 1647.35 | 1402.31 | 1403.03 | 1781.09 | 1761.21 | 1536.74 |

| Operating Profit (EBITDA) | 181.85 | 53.12 | 174.28 | 116.55 | 156.87 | 133.22 | 165.54 |

| Other Income | 20.13 | 12.82 | 17.69 | 24.58 | 14.39 | 17.23 | 9.96 |

| Depreciation and Amortization Expense | 63.92 | 47.92 | 38.75 | 36.72 | 27.92 | 26.67 | 17.97 |

| Profit Before Interest and Taxes | 138.06 | 18.01 | 153.22 | 104.41 | 143.34 | 123.77 | 157.53 |

| Finance Costs | 123.44 | 102.87 | 99.45 | 94.89 | 91.41 | 68.10 | 54.46 |

| Profit Before Tax and Exceptional Items Before Tax | 14.62 | -84.86 | 53.77 | 9.52 | 51.93 | 55.67 | 103.08 |

| Profit Before Tax | 14.62 | -84.86 | 53.77 | 9.52 | 51.93 | 55.67 | 103.08 |

| Income Tax | 1.92 | -24.72 | 16.63 | 3.48 | 17.10 | 12.36 | 21.83 |

| Profit for the Period from Continuing Operations | 12.70 | -60.14 | 37.14 | 6.04 | 34.83 | 43.31 | 81.25 |

| Profit for the Period | 12.70 | -60.14 | 37.14 | 6.04 | 34.83 | 43.31 | 81.25 |

Consolidated(in ₹ Cr.)

| Category | 31-Mar-2023 | 31-Mar-2022 | 31-Mar-2021 | 31-Mar-2020 | 31-Mar-2019 | 31-Mar-2018 | 31-Mar-2017 |

|---|---|---|---|---|---|---|---|

| Net Revenue | 2073.23 | 1730.31 | 1610.09 | 1639.68 | 1956.29 | 1902.94 | 1719.33 |

| Total Operating Cost | 1887.05 | 1671.63 | 1432.98 | 1499.81 | 1792.33 | 1766.38 | 1558.53 |

| Operating Profit (EBITDA) | 186.18 | 58.68 | 177.11 | 139.87 | 163.96 | 136.56 | 160.80 |

| Other Income | 18.68 | 12.74 | 17.45 | 22.29 | 14.46 | 21.72 | 17.84 |

| Depreciation and Amortization Expense | 63.94 | 47.98 | 38.83 | 36.77 | 27.97 | 26.72 | 23.25 |

| Profit Before Interest and Taxes | 140.92 | 23.43 | 155.74 | 125.39 | 150.45 | 131.56 | 155.40 |

| Finance Costs | 122.05 | 102.87 | 99.47 | 94.97 | 91.42 | 68.24 | 64.85 |

| Profit Before Tax and Exceptional Items Before Tax | 18.87 | -79.44 | 56.27 | 30.42 | 59.03 | 63.32 | 90.55 |

| Profit Before Tax | 18.87 | -79.44 | 56.27 | 30.42 | 59.03 | 63.32 | 90.55 |

| Income Tax | 4.38 | -16.50 | 18.12 | 7.92 | 17.89 | 12.72 | 20.94 |

| Profit for the Period from Continuing Operations | 14.49 | -62.94 | 38.15 | 22.50 | 41.15 | 50.60 | 69.61 |

| Profit for the Period | 14.49 | -62.94 | 38.15 | 22.50 | 41.15 | 50.60 | 69.61 |

Management of Vikram Solar Ltd.

HARI KRISHNA CHAUDHARY - Director

Shareholding in the company - 4.48 %

GYANESH CHAUDHARY - Managing Director

Shareholding in the company - 5.02 %

SAIBABA VUTUKURI - Chief Executive Officer

NEHA AGRAWAL - Wholetime Director

SUDIP CHATTERJEE - Company Secretary

RAJENDRA KUMAR PARAKH - Chief Financial Officer

PROBIR ROY - Director

JOGINDER PAL DUA - Director

VIKRAM SWARUP - Director

KRISHNA KUMAR MASKARA - Wholetime Director

FAQs of Vikram Solar Ltd.

Press of Vikram Solar Ltd.

Vikram Solar gets 250 MW module supply order from Gujarat Industries Power Company

Vikram Solar on Thursday announced securing a 250 MW solar module supply order from Gujarat Industries Power Company Ltd (GIPCL). It has received a Letter of Intent (LoI) from GIPCL, Vikram Solar said in a statement.

Vikram Solar appoints industry veteran Narayan Lodha as new CFO

New Delhi: Vikram Solar Ltd, a leader in the solar energy sector, has brought on board Narayan Lodha as its Chief Financial Officer (CFO), in a strategic move to amplify its operational and market expansion efforts.

Annual Report of Vikram Solar Ltd.

Vikram Solar Annual Report 2021-22Vikram Solar Annual Report 2020-21

Company Information of Vikram Solar Ltd.

ISIN: INE078V01014

Address: THE CHAMBERS, 8TH FLOOR 1865, RAJDANGA MAIN ROAD KOLKATA WEST BENGAL 700107

Email: secretarial@vikramsolar.com

Phone Number: +91-33-24427299

Date of Incorporation: 02-Dec-2005

Date of Last AGM: 19-Jul-2023

Data as Date: 31-Mar-2023

Source of Data: MCA, Toffler, Probe42