We are pleased to inform that the Board of HDFC Securities Limited at its meeting held on 1st March 2024 has approved the issue of shares on the Rights Basis in the ratio of 2 equity shares of Rs. 10/- each for every 19 equity shares held by the Shareholders, at a premium of Rs. 5,899/-. the Board has fixed Monday, 11th March 2024 as the record date for the purpose of determining the eligibility for Rights Issue.

| Quantity | Rate/Share |

|---|---|

| 100 - 1000 | 11880.00 |

| P/E | 19.48 | P/S | 6.96 | P/B | 9.12 |

|---|---|---|---|---|---|

| Industry PE | 55 | Face Value | 10 | Book Value | 1282.55 |

| Market Cap | 18518.32 Cr | Dividend | 510 | Dividend Yield | 4.36 % |

Corporate Action of HDFC Securities Unlisted Share

| Financial Year | Particulars | Record Date | Ratio/Rates/Amount | Remarks |

|---|---|---|---|---|

| 2023-24 | DIVIDEND | 22-Mar-2024 | 210 | HDFC Securities Ltd has given interim dividend of Rs 210/share. (RD is tentative) |

| 2023-24 | RIGHTS | 11-Mar-2024 | 2:19 | Right Issue Announced, 2 shares for every 19 shares at a premium of Rs 5899. Issue Period: 19-03-2024 to 06-04-2024. |

| 2023-24 | DIVIDEND | 27-Dec-2023 | 100 | HDFC Securities Ltd has given interim dividend of Rs 100/shares. (RD is tentative) |

| 2023-24 | DIVIDEND | 19-Jun-2023 | 100 | HDFC Securities Ltd has given interim dividend of Rs 100/shares. (RD is tentative) |

| 2022-23 | DIVIDEND | 20-Mar-2023 | 110 | HDFC Securities Ltd has given interim dividend of Rs 110/shares. |

| 2022-23 | DIVIDEND | 21-Dec-2022 | 110 | HDFC Securities Ltd has given interim dividend of Rs 110/shares. |

| 2022-23 | DIVIDEND | 16-Sep-2022 | 110 | HDFC Securities Ltd has given interim dividend of Rs 110/shares. (RD is tentative) |

| 2022-23 | DIVIDEND | 20-Jun-2022 | 110 | HDFC Securities Ltd has given interim dividend of Rs 110/shares. |

| 2021-22 | DIVIDEND | 17-Mar-2022 | 152 | HDFC Securities Ltd has given interim dividend of Rs 152/shares. |

| 2021-22 | DIVIDEND | 22-Jun-2021 | 120 | HDFC Securities Ltd has given interim dividend of Rs 120/shares. |

| 2021-22 | DIVIDEND | 21-Sep-2021 | 127 | HDFC Securities Ltd has given interim dividend of Rs 127/shares. |

| 2021-22 | DIVIDEND | 20-Dec-2021 | 148 | HDFC Securities Ltd has given interim dividend of Rs 148/shares. |

About of HDFC Securities

A reputable financial intermediary, HDFC Securities Limited is a division of HDFC Bank, one of India's leading private sector banks. Founded in 2000, this prominent stock broking company with its headquarters in Mumbai has had a remarkable 20 years of growth. HDFC Bank Limited, HDFC Limited, and Indocean eSecurities Holdings Limited collaborated to form HDFC Securities at first. In addition to offering excellent stock broking services, HDFC Securities has expanded into a well-known distributor of a range of financial products. Since its inception, the company has established itself as a preferred trading platform (for NSE & BSE), with its integrated 3-in-1 account (Trading + Demat + Savings) backed by state-of-the-art technology. A significant change happened in 2006 when HDFC Bank bought out HDFC Ltd. In 2008, an additional 4% was acquired from Indocean Securities, therefore consolidating HDFC Securities' status as an HDFC Bank subsidiary.

Overview of HDFC Securities

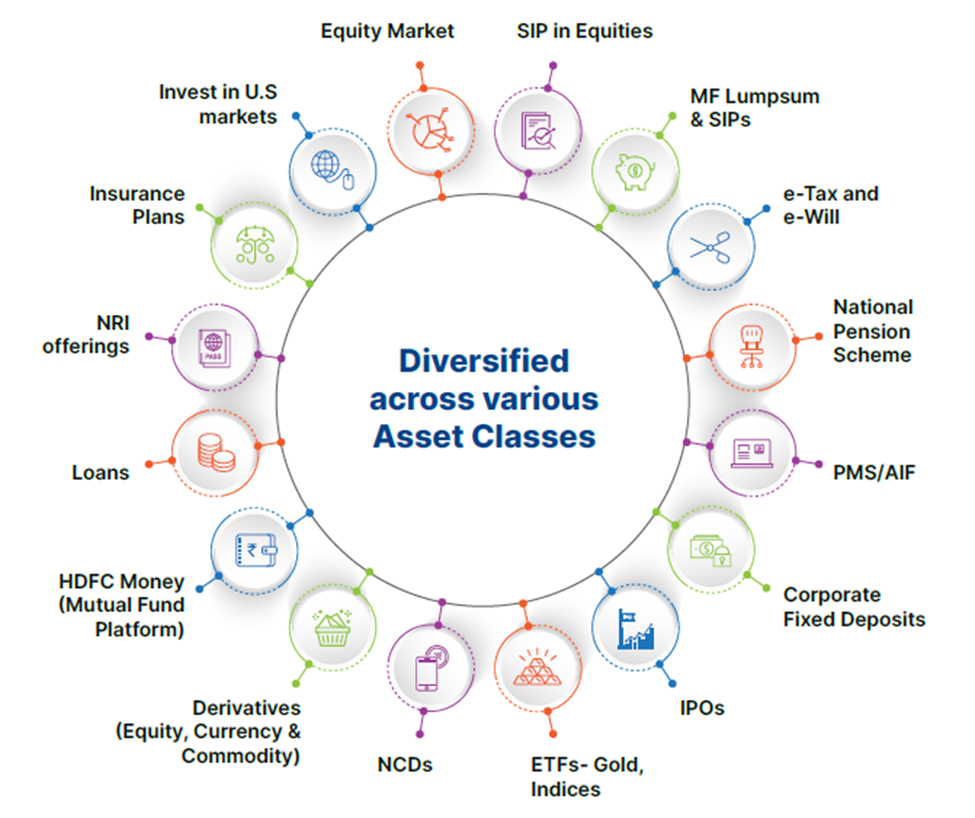

Product Offerings of HDFC Securities

HDFC Securities offers 3-in-1 online investment accounts, a combination of an account with HDFC bank and demat and trading services of HDFC Securities. The company offers a host of services to its clients, which include:

Management

Mr. Neeraj Swaroop – Chairman

·Mr. Neeraj Swaroop is an experienced professional with over 40 years in the FMCG industry.

·Ex-Standard Chartered Bank, Ex-HUL, Ex- Ponds India, Ex- Bank of America, Ex-HDFC Bank.

Mr. Dhiraj Relli – MD & CEO

·A member of the HDFC family since 2008, he has served as Senior Executive Vice President and Head of Branch Banking at HDFC Bank.

·BCom Hons. from Delhi University, Management program from IIM Bangalore, Chartered Accountant.

Business Overview

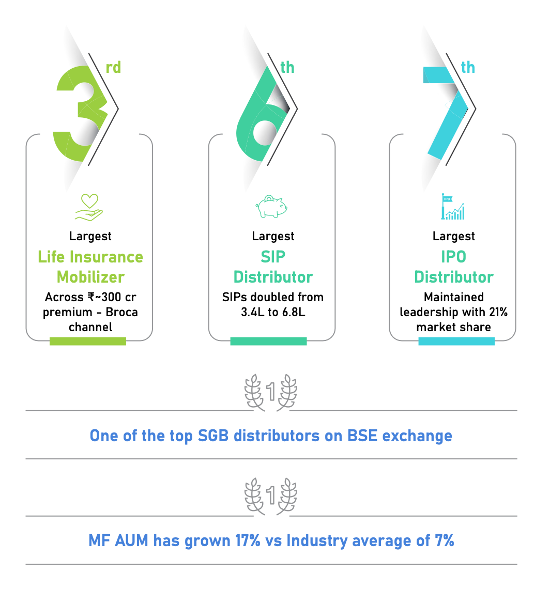

FY-23 Highlights

- 92% of 11.5 lakh active customers transact seamlessly on HDFC Securities digital platform.

- 52% of the total brokerage income i.e. ₹414 crores is generated through mobile transactions.

- HDFC Securities has a widespread distribution network with 209+ branches extended across 147 cities with 11 digital centers in India.

- More than 89% of the customers are onboarded through digital platform.

- HDFC Securities MF AUM has grown 17% vs Industry AUM growth of 7% due to increased focus on SIP book and new client participation.

- Revenue per employee : ₹66.68 lakhs

- The average book size for FY-23 under MTF stood at ₹3232 crores higher by 8% compared to previous FY-22 (2992 crores). The book size as of 31st March is positioned at ₹2752 crores.

Insights of HDFC Securities

Financial Insights

|

Particulars |

FY-23 |

FY-22 |

FY-21 |

FY-20 |

FY-19 |

|

Brokerage and fee income (In crores) |

1164 |

1409 |

1140 |

687 |

652 |

|

Earnings per share |

490 |

623 |

447 |

246 |

212 |

|

Dividend per share |

440 |

547 |

318 |

135 |

110 |

|

Profit after tax (In crores) |

777 |

984 |

703 |

384 |

348 |

|

Overall active clients (In lakhs) |

11.5 |

12.3 |

10.1 |

7.5 |

7.1 |

From FY-20 to FY-22, HDFC Securities profitability increased by 2.5 times, from ₹384 crores to ₹984 crores. Its profits for FY-23 were ₹777 crores, which resulted in consolidation due to sluggish market conditions, inflationary trends, and a higher base.

Business Segments

|

Particulars |

FY-23 |

FY-22 |

|

Brokerage and fee income |

1164 |

1409 |

|

Interest Income |

648 |

528 |

|

Net gain on fair value changes |

47 |

21 |

|

Sale of services |

11 |

15 |

|

Other Income |

19 |

15 |

|

Total income |

1892 |

1990 |

The company derives revenue primarily from the share broking business. Its other major revenue sources are interest income and services income.

Active Client Base

|

Active Clients (in lakhs) |

March -22 |

June-22 |

Sept-22 |

Dec-22 |

|

Zerodha |

62.8 |

65.8 |

66.8 |

65.9 |

|

Groww |

38.5 |

44.2 |

48.9 |

51.7 |

|

HDFC Securities |

11.4 |

11.7 |

11.7 |

11.3 |

|

Rksv Securities |

52.2 |

54.6 |

47.1 |

38.6 |

|

5 paisa |

17.5 |

16.5 |

14.3 |

10.8 |

It is evident that while the clientele of 5 paisa & Rksv Securities has significantly decreased, that of Hdfc Securities has remained nearly unchanged. Conversely, Groww's active clientele has increased significantly.

Peer Comparison

- Financials as of 31st March, 2023

- Share Price as of 30th November, 2023

|

Particulars |

HDFC Securities |

ICICI Securities |

Angel One |

|

Total Income |

1892 |

3425 |

3021 |

|

PAT |

777 |

1118 |

890 |

|

Market Price |

10000 |

668 |

3069 |

|

Market Cap |

15800 |

21376 |

25595 |

|

P/E |

20.40 |

17.5 |

25.5 |

|

P/B |

8.84 |

6.6 |

10.1 |

|

EPS |

490 |

38 |

121 |

Balance Sheet of HDFC Securities

Standalone(in ₹ Cr.)

| Category | 31-Mar-2024 | 31-Mar-2023 | 31-Mar-2022 | 31-Mar-2021 | 31-Mar-2020 | 31-Mar-2019 | 31-Mar-2018 | 31-Mar-2017 |

|---|---|---|---|---|---|---|---|---|

| Equity | 2029.00 | 1797.14 | 1657.91 | 1480.31 | 1247.60 | 1193.76 | 1036.85 | 807.41 |

| Liabilities | 12073.83 | 6470.86 | 6264.63 | 3278.60 | 1522.94 | 843.45 | 646.53 | 572.82 |

| Total Equity and Liabilities | 14103.07 | 8268.00 | 7922.54 | 4758.91 | 2770.54 | 2037.21 | 1683.38 | 1380.23 |

| Net Fixed Assets | 228.34 | 178.14 | 184.39 | 143.62 | 118.78 | 66.86 | 66.36 | 57.00 |

| Capital Work-in-progress | 0.45 | 28.74 | 14.70 | 10.79 | 13.13 | 10.72 | 9.27 | 3.88 |

| Other Non current Assets | 88.83 | 51.26 | 0.00 | 12.76 | 189.89 | 15.62 | 5.39 | 66.95 |

| Current Assets | 13785.45 | 8009.86 | 7723.45 | 4591.74 | 2448.74 | 1944.01 | 1602.36 | 1252.40 |

| Total Assets | 14103.07 | 8268.00 | 7922.54 | 4758.91 | 2770.54 | 2037.21 | 1683.38 | 1380.23 |

Profit and Loss of HDFC Securities

Standalone(in ₹ Cr.)

| Category | 31-Mar-2024 | 31-Mar-2023 | 31-Mar-2022 | 31-Mar-2021 | 31-Mar-2020 | 31-Mar-2019 | 31-Mar-2018 | 31-Mar-2017 |

|---|---|---|---|---|---|---|---|---|

| Net Revenue | 2660.12 | 1874.01 | 1975.57 | 1368.16 | 857.47 | 770.56 | 799.97 | 539.65 |

| Total Operating Cost | 724.88 | 475.42 | 465.46 | 364.45 | 294.11 | 256.68 | 260.25 | 209.31 |

| Operating Profit (EBITDA) | 1935.24 | 1398.59 | 1510.11 | 1003.71 | 563.36 | 513.88 | 539.72 | 330.34 |

| Other Income | 0.61 | 17.62 | 14.74 | 31.27 | 4.79 | 0.10 | 0.10 | 13.55 |

| Depreciation and Amortization Expense | 64.00 | 57.45 | 42.30 | 36.29 | 30.36 | 18.64 | 15.13 | 14.44 |

| Profit Before Interest and Taxes | 1872.00 | 1358.76 | 1482.55 | 998.69 | 537.79 | 495.34 | 524.69 | 329.45 |

| Finance Costs | 600.50 | 316.86 | 162.24 | 53.07 | 28.78 | 0.11 | 0.07 | 0.00 |

| Profit Before Tax and Exceptional Items Before Tax | 1271.00 | 1041.90 | 1320.31 | 945.62 | 509.01 | 495.23 | 524.62 | 329.45 |

| Profit Before Tax | 1271.00 | 1041.90 | 1320.31 | 945.62 | 509.01 | 495.23 | 524.62 | 329.45 |

| Income Tax | 321.00 | 264.68 | 335.97 | 242.39 | 124.86 | 165.41 | 179.89 | 113.55 |

| Profit for the Period from Continuing Operations | 950.89 | 777.22 | 984.34 | 703.23 | 384.15 | 329.82 | 344.73 | 215.90 |

| Profit for the Period | 950.89 | 777.22 | 984.34 | 703.23 | 384.15 | 329.82 | 344.73 | 215.90 |

Consolidated(in ₹ Cr.)

| Category | 31-Mar-2024 | 31-Mar-2023 | 31-Mar-2022 | 31-Mar-2021 | 31-Mar-2020 | 31-Mar-2019 | 31-Mar-2018 | 31-Mar-2017 |

|---|---|---|---|---|---|---|---|---|

| Net Revenue | 2660.12 | 1874.01 | 1975.57 | 1368.16 | 857.47 | 770.56 | 799.97 | 539.65 |

| Total Operating Cost | 724.88 | 475.42 | 465.46 | 364.45 | 294.11 | 256.68 | 260.25 | 209.31 |

| Operating Profit (EBITDA) | 1935.24 | 1398.59 | 1510.11 | 1003.71 | 563.36 | 513.88 | 539.72 | 330.34 |

| Other Income | 0.61 | 17.62 | 14.74 | 31.27 | 4.79 | 0.10 | 0.10 | 13.55 |

| Depreciation and Amortization Expense | 64.00 | 57.45 | 42.30 | 36.29 | 30.36 | 18.64 | 15.13 | 14.44 |

| Profit Before Interest and Taxes | 1872.00 | 1358.76 | 1482.55 | 998.69 | 537.79 | 495.34 | 524.69 | 329.45 |

| Finance Costs | 600.50 | 316.86 | 162.24 | 53.07 | 28.78 | 0.11 | 0.07 | 0.00 |

| Profit Before Tax and Exceptional Items Before Tax | 1271.00 | 1041.90 | 1320.31 | 945.62 | 509.01 | 495.23 | 524.62 | 329.45 |

| Profit Before Tax | 1271.00 | 1041.90 | 1320.31 | 945.62 | 509.01 | 495.23 | 524.62 | 329.45 |

| Income Tax | 321.00 | 264.68 | 335.97 | 242.39 | 124.86 | 165.41 | 179.89 | 113.55 |

| Profit for the Period from Continuing Operations | 950.89 | 777.22 | 984.34 | 703.23 | 384.15 | 329.82 | 344.73 | 215.90 |

| Profit for the Period | 950.89 | 777.22 | 984.34 | 703.23 | 384.15 | 329.82 | 344.73 | 215.90 |

Management of HDFC Securities

DHIRAJ RELLI - Managing Director

Shareholding in the company - 0.19 %

ASHISH KAMALKISHORE RATHI - Wholetime Director

Shareholding in the company - 0.04 %

JAGDISH CAPOOR - Director

KUNAL SURESH SANGHAVI - Chief Financial Officer

VENKATAKRISHNAN EASWARAN NURANI - Company Secretary

MALAY YOGENDRA PATEL - Director

SAMIR VIJAY BHATIA - Director

BHARAT DHIRAJLAL SHAH - Director

AMLA ASHIM SAMANTA - Director

ABHAY AIMA - Director

FAQs of HDFC Securities

Press of HDFC Securities

HDFC Sec takes on Zerodha, Groww with new platform Sky bets big on margin trading facility

HDFC Securities on September 25 announced the launch of HDFC SKY, a discount broking all-in-one app for investing and trading at one-price slab of Rs 20. This fee is similar to that of online broking platforms Groww, 5Paisa and Zerodha.

Alleged HDFC Bank subsidiary data breach: The inside story

The recent alleged HDB Financial Services data breach has come in at a time when breaches and hacks are assuming a common place stature. A bank data breach continues to raise brows - and understandably so since the BFSI is a highly regulated domain.

Company Information of HDFC Securities

ISIN: INE700G01014

Address: I THINK TECHNO CAMPUS, BLD - B, "ALPHA", OFFICE FLOOR 8, OPP. CROMPTON GREAVES, KANJURMARG (E) MUMBAI MAHARASHTRA 400042

Email: complianceofficer@hdfcsec.com

Phone Number: +91-9821414499

Date of Incorporation: 17-Apr-2000

Date of Last AGM: 15-Jul-2022

Data as Date: 31-Mar-2023

Source of Data: MCA, Toffler