NEW DELHI: The value of the Indian Premier League (IPL) increased by 6.5 per cent, reaching USD 16.4 billion (approximately Rs 1,34,858 crore) in 2024, as reported by American investment bank Houlihan Lokey.

| Quantity | Rate/Share |

|---|---|

| 100 - 1000 | 172.00 |

| P/E | 97.69 | P/S | 16 | P/B | 16.9 |

|---|---|---|---|---|---|

| Industry PE | 0 | Face Value | 0.1 | Book Value | 10 |

| Market Cap | 5207.79 Cr | Dividend | 0 | Dividend Yield | 0 % |

About of Chennai Super Kings ( CSK )

Chennai Super Kings (CSK), established in 2008, are not just an IPL franchise, but a cultural phenomenon deeply embedded in the Indian cricket landscape. Chennai Super Kings was initially backed by the esteemed India Cements Limited with an initial investment of ₹150 crore. Since then, CSK has solidified its presence in the cricketing world, emerging not only as a team but as a symbol of cricketing excellence and sportsmanship. Amidst the array of IPL teams, CSK has carved a niche for itself, garnering immense admiration and support from fans across the globe. With an illustrious history, they have participated in a record 10 finals, won a record five IPL titles in 2010, 2011, 2018, 2021, 2023 and qualified for the playoffs 12 times out of the 14 seasons they have played in, which is more than any other franchise. They are one of the most valuable IPL franchise with a valuation of roughly $1.15 billion as of 2022.

Overview of Chennai Super Kings ( CSK )

In September 2014, the Chennai Super Kings’ parent business, India Cements, made the decision to demerge the IPL franchise to a wholly-owned subsidiary, CSKCL. Chennai Super Kings remained owned by India Cements after being converted from a division to a 100% subsidiary. In 2008, India Cements made a $91 million proposal for the Chennai franchise and the sum that needed to be paid in ten years. The company set a record date of October 9, 2015, with the intention of distributing CSKCL shares in the ratio of 1:1 to India Cements Ltd. Shareholders.

An Overview

- The Indian premier league’s (IPL) brand value is at $3.2 billion in 2023, from $1.8 billion in 2022, an increase of 80 percent.

- The league’s business value also saw an increase of 80 percent and is worth $15.4 billion in 2023. One of the main reasons for this increase is the media rights deal with JioCinema and Disney Star, which is 3x the price of the five-year deal between Disney Star and the Board of Control for Cricket in India (BCCI) in 2017.

- As per the report, the media rights are expected to further increase during the next cycle. So far, the media rights have grown at a CAGR of 18 percent, between 2008 and 2023.

- The IPL is expected to go global by the next cycle in 2027 on similar lines to EPL, which would further enhance the growth in its revenue from broadcasting rights.

- Chennai Super Kings (CSK) was the number one IPL franchisee in terms of brand valuation, with $212 million in 2023, witnessing a growth of 45.2 percent from $146 million last year.

- Reason? Without a doubt the team’s captain MS Dhoni’s cult fan following and five title wins. This has helped in creating a strong brand identity.

From Seasonal to Evergreen: CSK's Formula for Sustainable Business Growth

• Chennai Super Kings (CSK) is more than just an IPL team - it's a global cricket powerhouse

• Not content with dominating the Indian cricket scene, CSK has recently ventured into the South Africa T20 (SA20) league with its Johannesburg-based franchise named Joburg Super Kings

• The CEO of CSK, Mr. Kasi Viswanathan, has stated that the team plans to be the world's leading T20 franchise by 2030

• To reach this ambitious target, CSK is planning to invest a whopping Rs. 150-200 crores in building a High-Performance Centre at Navalur - a move that's sure to boost the team's training and development capabilities to new heights

IPL Media Rights Auction

·On June 15, 2022, the Indian Premier League (IPL) achieved a significant milestone when the BCCI sold the media rights for the 2023–2027 season for Rs 48,075 Cr. TV rights brought in Rs 22,575 Cr, while internet rights brought in Rs 21,500 Cr for 410 matches. Read more about how IPL 2023 Ad Revenue Crossed. Rs 10,000 Cr!

·TV Rights for the Indian subcontinent have been sold to The Walt Disney Company India owned Star, while the digital rights have been bagged by Viacom18. The league signed a major title deal with TATA for Rs, 670 Cr.

·The Five Year revenue just from IPL Media Rights stands at upwards of Rs 2400 Cr for Chennai Super Kings (CSK) from FY 2023 onwards.

·IPL Media Rights for the period 2018-22: Star Sports had picked up the composite rights for Rs 16,347 Cr. By virtue of these rights, the revenue share of franchises over the next 5-year period was 50% of the above amount after deducting the production expenses incurred during the season.

·The league also signed a major title deal with VIVO for Rs, 2199 crore for the same period. ( 2018-2022). A combination of sponsorship and media rights ensures, the franchise will receive over Rs 1000 crore in the form of central revenue over the next five years from the BCCI-IPL. However, the Franchisees have to share 20% of the income with BCCI.

CSK Sponsors

CSK recently entered into an agreement with Gulf carrier Etihad Airways to become its official sponsor in 2024. CSK has a lot of brands under its belt like – The Muthoot Group, India Cements, Jio, Dream 11 etc.

Insights of Chennai Super Kings ( CSK )

Financial Insights

During the year the company made a profit of 52 crores on a standalone basis but its subsidiary Superking Ventures Private limited incurred a loss of 6 crores mainly due to one-time costs on account of setting up the academies. It’s another subsidiary Joburg Super Kings Ltd. also suffered a loss of 32 crores and the Company believes that this venture will add significant value to the shareholders despite investments in the initial few years. Losses from these 2 subsidiaries led the profitability to around 14 crores on a consolidated basis.

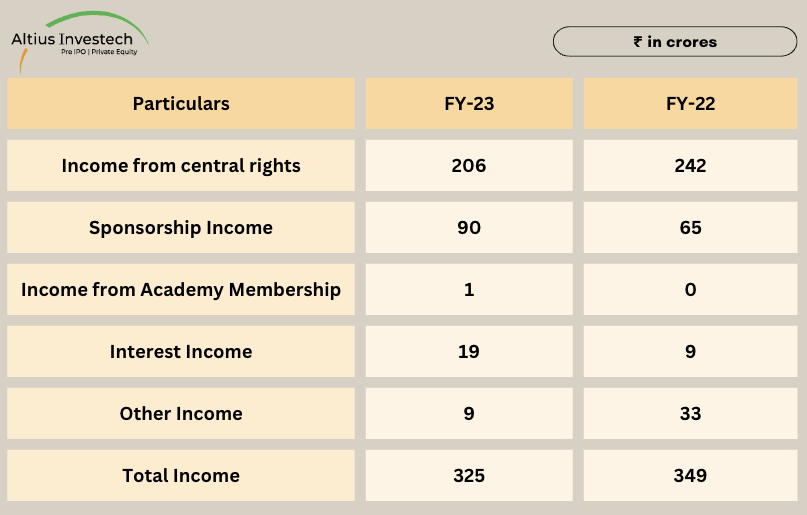

Revenue Split

Valuations in comparison to peers

·Mumbai Indians owned by Reliance Industries - a brand value of $190 million.

·Kolkata Knight Riders owned by Red Chillies Entertainment is estimated at $181 million approx.

·Royal Challengers Bangalore backed by United Spirits of Vijay Mallya earlier, now Diageo is estimated brand value of $195 million.

Chennai Super Kings

As of 2023, CSK boasts the highest brand value among all IPL teams, estimated at $212 million.

However, Forbes recently valued the company around $1.15 billion, ranking second among IPL teams behind Mumbai Indians. Read more about Chennai Super Kings – FY2022 Highlights.

Balance Sheet of Chennai Super Kings ( CSK )

Standalone(in ₹ Cr.)

| Category | 31-Mar-2023 | 31-Mar-2022 | 31-Mar-2021 | 31-Mar-2020 | 31-Mar-2019 | 31-Mar-2018 | 31-Mar-2017 |

|---|---|---|---|---|---|---|---|

| Equity | 301.00 | 248.24 | 216.12 | 175.85 | 125.52 | 14.31 | 14.83 |

| Liabilities | 189.40 | 142.08 | 100.11 | 89.74 | 190.65 | 175.78 | 1.61 |

| Total Equity and Liabilities | 490.40 | 390.32 | 316.22 | 265.60 | 316.17 | 190.09 | 16.43 |

| Net Fixed Assets | 139.13 | 135.80 | 144.78 | 143.25 | 3.51 | 0.00 | 0.00 |

| Capital Work-in-progress | 17.01 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Other Non current Assets | 70.67 | 47.26 | 22.17 | 21.00 | 126.47 | 0.56 | 0.00 |

| Current Assets | 263.58 | 207.26 | 149.28 | 101.35 | 186.18 | 189.54 | 16.43 |

| Total Assets | 490.39 | 390.32 | 316.22 | 265.60 | 316.17 | 190.09 | 16.43 |

Consolidated(in ₹ Cr.)

| Category | 31-Mar-2023 | 31-Mar-2022 |

|---|---|---|

| Equity | 261.53 | 248.73 |

| Liabilities | 199.12 | 142.33 |

| Total Equity and Liabilities | 460.65 | 391.06 |

| Net Fixed Assets | 145.98 | 136.04 |

| Capital Work-in-progress | 17.01 | 0.00 |

| Other Non current Assets | 32.06 | 47.08 |

| Current Assets | 270.81 | 207.37 |

| Total Assets | 465.86 | 390.49 |

Profit and Loss of Chennai Super Kings ( CSK )

Standalone(in ₹ Cr.)

| Category | 31-Mar-2023 | 31-Mar-2022 | 31-Mar-2021 | 31-Mar-2020 | 31-Mar-2019 | 31-Mar-2018 | 31-Mar-2017 |

|---|---|---|---|---|---|---|---|

| Net Revenue | 273.15 | 341.05 | 247.83 | 350.27 | 410.57 | 2.85 | 2.95 |

| Total Operating Cost | 208.12 | 299.72 | 185.90 | 282.27 | 254.09 | 3.85 | 4.38 |

| Operating Profit (EBITDA) | 65.03 | 41.33 | 61.93 | 68.00 | 156.48 | -1.01 | -1.43 |

| Other Income | 19.19 | 8.09 | 5.86 | 6.27 | 7.27 | 1.23 | 0.43 |

| Depreciation and Amortization Expense | 3.63 | 2.40 | 3.34 | 1.64 | 1.19 | 0.00 | 0.00 |

| Profit Before Interest and Taxes | 80.59 | 47.02 | 64.46 | 72.63 | 162.55 | 0.22 | -1.00 |

| Finance Costs | 10.05 | 5.67 | 5.26 | 5.37 | 5.68 | 1.29 | 0.00 |

| Profit Before Tax and Exceptional Items Before Tax | 70.54 | 41.35 | 59.20 | 67.25 | 156.87 | -1.07 | -1.00 |

| Profit Before Tax | 70.54 | 41.35 | 59.20 | 67.25 | 156.87 | -1.07 | -1.00 |

| Income Tax | 18.35 | 9.21 | 18.94 | 16.91 | 45.67 | -0.56 | 0.00 |

| Profit for the Period from Continuing Operations | 52.19 | 32.14 | 40.26 | 50.34 | 111.20 | -0.51 | -1.00 |

| Profit for the Period | 52.19 | 32.14 | 40.26 | 50.34 | 111.20 | -0.51 | -1.00 |

Consolidated(in ₹ Cr.)

| Category | 31-Mar-2023 | 31-Mar-2022 |

|---|---|---|

| Net Revenue | 305.85 | 341.05 |

| Total Operating Cost | 277.82 | 299.63 |

| Operating Profit (EBITDA) | 28.03 | 41.42 |

| Other Income | 19.44 | 8.09 |

| Depreciation and Amortization Expense | 5.03 | 2.51 |

| Profit Before Interest and Taxes | 42.44 | 47.00 |

| Finance Costs | 10.30 | 6.26 |

| Profit Before Tax and Exceptional Items Before Tax | 32.14 | 40.74 |

| Profit Before Tax | 32.14 | 40.74 |

| Income Tax | 18.35 | 9.21 |

| Profit for the Period from Continuing Operations | 13.79 | 31.53 |

| Profit for the Period | 13.79 | 31.53 |

Management of Chennai Super Kings ( CSK )

SRINIVASAN RANGANATHAN - Director

Shareholding in the company - 0.01 %

SUBRAMANIAN PALANIAPPAN - Director

Shareholding in the company - 0.01 %

RAMGOPAL KALATHINGAL - Director

Shareholding in the company - 0.01 %

KALIDAIKURUCHI SUBRAMANIAM VISWANATHAN - Chief Executive Officer

KALIDAIKURUCHI SUBRAMANIAM VISWANATHAN - Wholetime Director

JAYASHREE EKAMBARAM - Director

SABARETNAM LAKSHMANAN - Director

KALYANASUNDARAM BALASUBRAMANYAM - Director

RAKESH SINGH - Director

FAQs of Chennai Super Kings ( CSK )

Press of Chennai Super Kings ( CSK )

Bollywood Actress Katrina Kaif Becomes Brand Ambassador Of MS Dhoni’s Chennai Super Kings (CSK) – Report

New Delhi: Bollywood actress Katrina Kaif is likely to join the fan-favorite Indian Premier League franchise, Chennai Super Kings as its brand ambassador. MS Dhoni’s CSK will be entering the upcoming edition of IPL 2024 as the defending champions and Katrina Kaif joining the franchise will only add more to their already humongous brand value.

Aditya Birla Group And Tata Sons Compete For IPL Sponsorship Rights

Aditya Birla Group (ABG) and Tata Sons are currently in competition for the title sponsorship rights of the Indian Premier League (IPL). Bids for this highly sought-after marketing opportunity had to be submitted by January 12.

Annual Report of Chennai Super Kings ( CSK )

Chennai Super Kings Limited (CSK) Annual Report 2022-2023Chennai Super Kings Limited (CSK) Annual Report 2021-2022

Chennai Super Kings Limited (CSK) Annual Report 2020-2021

Chennai Super Kings Limited (CSK) Annual Report 2019-2020

Chennai Super Kings Limited (CSK) Annual Report 2018-2019

Company Information of Chennai Super Kings ( CSK )

ISIN: INE852S01026

Address: DHUN BUILDING 827, ANNA SALAI, CHENNAI TAMIL NADU 600002

Email: investor@chennaisuperkings.com

Phone Number: +91-44-28521451

Date of Incorporation: 19-Dec-2014

Date of Last AGM: 18-Sep-2021

Data as Date: 31-Mar-2022

Source of Data: MCA, Toffler, Probe42