Private equity fund Tiger Pacific Capital has acquired close to 4% of B9 Beverages, maker of Bira 91 beer and owner of pub chain The Beer Cafe, for $25 million (Rs 207 crore).

| Quantity | Rate/Share |

|---|---|

| 100 - 1000 | 575.00 |

| P/E | -10.28 | P/S | 6.06 | P/B | -34.88 |

|---|---|---|---|---|---|

| Industry PE | 52.07 | Face Value | 10 | Book Value | -16.63 |

| Market Cap | 4995.25 Cr | Dividend | 0 | Dividend Yield | 0 % |

Established in the summer of 2015 by B9 Beverages and headquartered in New Delhi, Bira 91 has quickly become the rage amongst urban millennials owing to its delicious beers, bold identity, and strong draft network. It is crafted with the creative urban drinker in mind someone who likes to have fun and the brand aims to disrupt the global beer world with 21st-century technology and its playful monkey mascot. In 2017, Bira 91 leaped across to New York City to begin its campaign in the United States. It has a passionate team of over 350 beer lovers who have only one goal - to change the world of beer and beer for the world.

The founder of Bira, Ankur Jain, during his stint in New York, had co-founded a health management start-up, Reliant MD. One of the US's most famous craft breweries, Brooklyn Brewery, was close to his place of business and his passion for craft beer expanded as he visited the brewery every Saturday afternoon. Upon his return to India, he discovered that there were no possibilities for Craft Beer. Jain decided to pivot after realising there was a market for beer in India.

Destiny and Jain‘s passion for craft beer made his dream come true in 2007 when he founded the Cerana Beverages (now B9 Beverages). A company that imported and distributed craft beer brands from Belgium, Germany and the US. Jain's experience helped him understand intricacies and the Indian taste palate much better. The beer was marketed in 330 ml bottles in Delhi, Mumbai and Bangalore. Cerena Beverages which is a beverage importer and distributor, controls India’s first and largest draught beer distribution network, which is found in restaurants and pubs across the country.

Timeline

→ 2015 : Ankur Starts Bira 91 and launches wheat beers in Hauz Khas Village, New Delhi

→ 2016 : Bira91 begins production in India from its first brewery at Maksi

→ 2017 : Annual gross revenue crosses $55 million

→ 2018 : Bira 91 becomes the largest draft beer brand in India

→ 2020 : Annual gross revenue crosses $100 million and starts limited release taproom in Bangalore

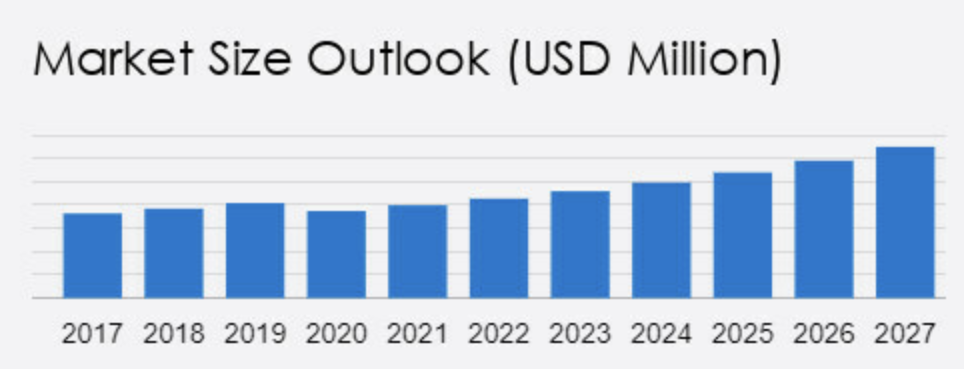

The beer market in India is estimated to increase by USD 4,449.19 million from 2022 to 2027. The market's growth momentum will progress at a CAGR of 8.76% during the forecast period. The market is fragmented due to the presence of diversified international and regional vendors. The growth of online retailing of beer is notably driving the market growth. In India, the use of the Internet for beer sales and marketing is increasing. However, e-commerce is helping small businesses such as craft beer makers get their products in front of a wide range of customers. Beer availability on online trading platforms expands vendor visibility and It also allows vendors to sell more to Internet-savvy customers.

Bira 91 has raised a total funding of $336M over 17 rounds till date whereas the last funding raised from Tiger Pacific Capital was valued at 5187 crores.

|

Year |

Amount |

Investors |

|

2016 |

$6 M |

Sequoia Capital, Kunal Bahl and Rohit Bansal (Co-founders - Snapdeal), Deepinder Goyal (zomato), Ashish Dhawan (ChrysCapital) |

|

2018 |

$50 M |

In 2018, the company raised a further amount of $50 million from Sofina, a Belgian family owned fund and its existing investors. |

|

2019 |

$14.3 M |

In May 2019, Bira 91 raised the funding of $4.3M from Sixth Sense Ventures in its Pre-Series C round. Bira raised $10 million in debt funding, to increase production capacity from 400,000 cases to 1.7 million cases. |

|

2021 |

$70 M |

Japanese integrated beverages Kirin Holdings invested $70MN valuing the alco-beverage firm between $230 mn to $240 mn. Bira is Kirin Holdings first investment in India. |

|

2023 |

$10 M |

Bira 91, an Indian craft beer maker, has raised $10 million from Japan's MUFG Bank. |

|

2024 |

$25 M |

The $25 million investment by Tiger Pacific Capital translates to approximately a 4% stake in B9 Beverages, valuing Bira 91 at around $625 million. |

· Revenue Doubled in 2 years from FY-21 to FY-23 and increased by 17% from FY-22 to FY-23.

· Bira 91 growth remained sluggish as compared to FY22. The sale of beer comprised almost all its sales and income from this channel grew only 13% in FY23 which impacted its topline growth.

Standalone(in ₹ Cr.)

| Category | 31-Mar-2023 | 31-Mar-2022 | 31-Mar-2021 | 31-Mar-2020 | 31-Mar-2019 | 31-Mar-2018 | 31-Mar-2017 |

|---|---|---|---|---|---|---|---|

| Equity | 508.95 | 55.91 | 114.58 | 18.26 | 261.41 | 109.10 | 72.30 |

| Liabilities | 980.95 | 936.32 | 806.61 | 567.81 | 156.27 | 186.94 | 23.82 |

| Total Equity and Liabilities | 1489.90 | 992.23 | 921.19 | 586.07 | 417.69 | 296.04 | 96.12 |

| Net Fixed Assets | 378.27 | 360.01 | 77.84 | 79.15 | 52.52 | 26.76 | 16.91 |

| Capital Work-in-progress | 13.61 | 7.17 | 277.41 | 243.20 | 6.12 | 5.32 | 6.96 |

| Other Non current Assets | 483.02 | 261.55 | 196.50 | 60.68 | 164.48 | 28.16 | 6.03 |

| Current Assets | 615.01 | 363.50 | 369.44 | 203.04 | 194.57 | 235.80 | 66.21 |

| Total Assets | 1489.90 | 992.23 | 921.19 | 586.07 | 417.69 | 296.04 | 96.12 |

Consolidated(in ₹ Cr.)

| Category | 31-Mar-2023 | 31-Mar-2022 | 31-Mar-2020 | 31-Mar-2019 | 31-Mar-2018 | 31-Mar-2017 |

|---|---|---|---|---|---|---|

| Equity | 161.86 | -222.84 | -38.50 | 114.76 | 27.59 | 71.20 |

| Liabilities | 1112.30 | 952.91 | 592.68 | 167.51 | 193.18 | 24.07 |

| Total Equity and Liabilities | 1274.16 | 730.07 | 554.19 | 282.28 | 220.77 | 95.27 |

| Net Fixed Assets | 568.11 | 364.68 | 83.21 | 57.30 | 31.86 | 17.03 |

| Capital Work-in-progress | 15.17 | 8.41 | 243.84 | 6.73 | 5.32 | 6.96 |

| Other Non current Assets | 74.42 | 65.14 | 29.76 | 20.35 | 8.42 | 4.36 |

| Current Assets | 616.46 | 291.84 | 197.39 | 197.89 | 175.17 | 66.92 |

| Total Assets | 1274.16 | 730.07 | 554.19 | 282.28 | 220.77 | 95.27 |

Standalone(in ₹ Cr.)

| Category | 31-Mar-2023 | 31-Mar-2022 | 31-Mar-2021 | 31-Mar-2020 | 31-Mar-2019 | 31-Mar-2018 | 31-Mar-2017 |

|---|---|---|---|---|---|---|---|

| Net Revenue | 810.13 | 717.77 | 428.21 | 457.19 | 350.37 | 158.23 | 30.96 |

| Total Operating Cost | 1022.37 | 890.99 | 523.65 | 613.88 | 470.46 | 229.63 | 83.86 |

| Operating Profit (EBITDA) | -212.24 | -173.22 | -95.44 | -156.69 | -120.10 | -71.40 | -52.90 |

| Other Income | 36.43 | 15.98 | 34.62 | 6.46 | 9.72 | 2.01 | 1.05 |

| Depreciation and Amortization Expense | 119.77 | 90.09 | 74.24 | 57.21 | 5.26 | 3.04 | 1.87 |

| Profit Before Interest and Taxes | -295.58 | -247.33 | -135.06 | -207.44 | -115.64 | -72.43 | -53.72 |

| Finance Costs | 95.91 | 87.72 | 76.20 | 49.90 | 19.40 | 8.34 | 1.17 |

| Profit Before Tax and Exceptional Items Before Tax | -391.49 | -335.05 | -211.26 | -257.34 | -135.04 | -80.76 | -54.89 |

| Exceptional Items Before Tax | 0.00 | 0.00 | 0.00 | -160.07 | 0.00 | 59.39 | 0.00 |

| Profit Before Tax | -391.49 | -335.05 | -211.26 | -417.41 | -135.04 | -21.37 | -54.89 |

| Profit for the Period from Continuing Operations | -391.49 | -335.05 | -211.26 | -417.41 | -135.04 | -21.37 | -54.89 |

| Profit for the Period | -391.49 | -335.05 | -211.26 | -417.41 | -135.04 | -21.37 | -54.89 |

Consolidated(in ₹ Cr.)

| Category | 31-Mar-2023 | 31-Mar-2022 | 31-Mar-2020 | 31-Mar-2019 | 31-Mar-2018 | 31-Mar-2017 |

|---|---|---|---|---|---|---|

| Net Revenue | 824.32 | 718.85 | 478.75 | 354.98 | 158.68 | 30.96 |

| Total Operating Cost | 1064.40 | 942.64 | 707.75 | 540.76 | 250.46 | 83.99 |

| Operating Profit (EBITDA) | -240.08 | -223.79 | -229.00 | -185.78 | -91.78 | -53.03 |

| Other Income | 24.40 | 7.62 | 15.02 | 9.39 | 2.02 | 1.00 |

| Depreciation and Amortization Expense | 121.42 | 90.81 | 58.28 | 5.95 | 3.70 | 1.87 |

| Profit Before Interest and Taxes | -337.10 | -306.98 | -272.25 | -182.34 | -93.46 | -53.90 |

| Finance Costs | 96.60 | 89.08 | 49.90 | 19.45 | 8.34 | 1.17 |

| Profit Before Tax and Exceptional Items Before Tax | -433.70 | -396.06 | -322.15 | -201.79 | -101.80 | -55.06 |

| Exceptional Items Before Tax | 0.00 | 0.00 | -0.42 | 0.00 | 0.00 | 0.00 |

| Profit Before Tax | -433.70 | -396.06 | -322.57 | -201.79 | -101.80 | -55.06 |

| Income Tax | 11.79 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Profit for the Period from Continuing Operations | -445.48 | -396.06 | -322.57 | -201.79 | -101.80 | -55.06 |

| Profit for the Period | -445.48 | -396.06 | -322.57 | -201.79 | -101.80 | -55.06 |

ANKUR JAIN - Managing Director

Shareholding in the company - 29.36 %

SHASHI JAIN - Director

Shareholding in the company - 16.33 %

SAKSHI VIJAY CHOPRA - Nominee Director

The lock-in period of unlisted shares depends on the category of investors

This regulation was brought by SEBI in August 2021. The purpose of the regulation change of lower lock-in period, was primarily to promote greater participation and investments before the IPO listing. Hence, PMS< retail investors, institutions can enjoy better liquidity.

Unlisted share price determination is also driven by same values – Fundamental values and current demand and supply.

We generally address ticket size of Rs 25000 (closest round off).

Private equity fund Tiger Pacific Capital has acquired close to 4% of B9 Beverages, maker of Bira 91 beer and owner of pub chain The Beer Cafe, for $25 million (Rs 207 crore).

Japanese beverages group Kirin Holdings is investing $25 million (about ?205 crore) to buy an additional minority stake in B9 Beverages, the maker of craft beer Bira 91 and owner of pub chain Beer Cafe, executives aware of the development said.

New Delhi: B9 Beverages, maker of Bira 91 beer and owner of The Beer Cafe pub chain, is set to raise Rs 400 crore ($50 million) of fresh funds, executives close to the development said. The money, from existing investors as well as a new one, will be used to expand business.

B9 Beverages, the maker of Bira 91 beer plans to raise Rs. 400 crore in fresh funding. The funds are set to come from existing investors as well as a new one. The current investors include Japan\'s Kirin Holdings, Sequoia Capital and Sofina of Belgium. The company plans to raise finds to expand its current business.

Delhi NCR-based beer brand Bira 91’s revenue inched closer to the INR 1,000 Cr mark in the financial year 2022-23 (FY23). The popular beer maker reported an operating revenue of INR 824.3 Cr in the year ended March 31, 2023, an increase of 15% from INR 718.8 Cr in the previous fiscal year.

Just so colourful! We\'re referring to the recently released limited edition shoes created in collaboration between Crocs and Bira 91. The well-known and incredibly comfy Crocs have undergone a fun makeover, and the Classic Clogs include the go-to alcoholic favourite Bira\'s distinctive monkey logo and other essential icons that make the footwear ideal for young people in metropolitan areas. Funky and fashionable, a pair of these can spice up your wardrobe and have your friends hounding you for more information.

ISIN: INE833U01014

Address: PREMISE NO. 106, SECOND FLOOR BLOCK H, CONNAUGHT CIRCUS NEW DELHI DELHI 110001

Email: info@bira91.com

Phone Number: 180030023010

Date of Incorporation: 28-May-2012

Date of Last AGM: 19-Feb-2021

Data as Date: 31-Dec-2020

Source of Data: MCA, Toffler, Probe42